corporate tax increase us

Web The Tax Foundation estimated BBBA would raise 17 trillion of gross. Web The budget also would increase the corporate tax rate from the current.

Gov Walz S Corporate Income Tax Hike Would Give Mn Highest Starting Rate Of Corporate Income Tax Faced By Smaller Businesses In The U S American Experiment

Web The White House lists corporate tax increase proposals that include.

. Web The increase in the corporate tax rate in the USA and the consequences. Web Published by Statista Research Department Sep 30 2022. Ad Leading Federal Tax Law Reference Guide.

Web For the sake of argument suppose that federal revenue under the current. Web Eighty-seven percent of these revenues are raised from 5 major changes. Web Big US business groups are blasting a 740 billion legislative package on.

Web The Environmental Protection Agency EPA recently proposed raising the. Discussion And Analysis Of Significant Issues Related To Accounting For Expenses. Corporate tax rate to rise from 21.

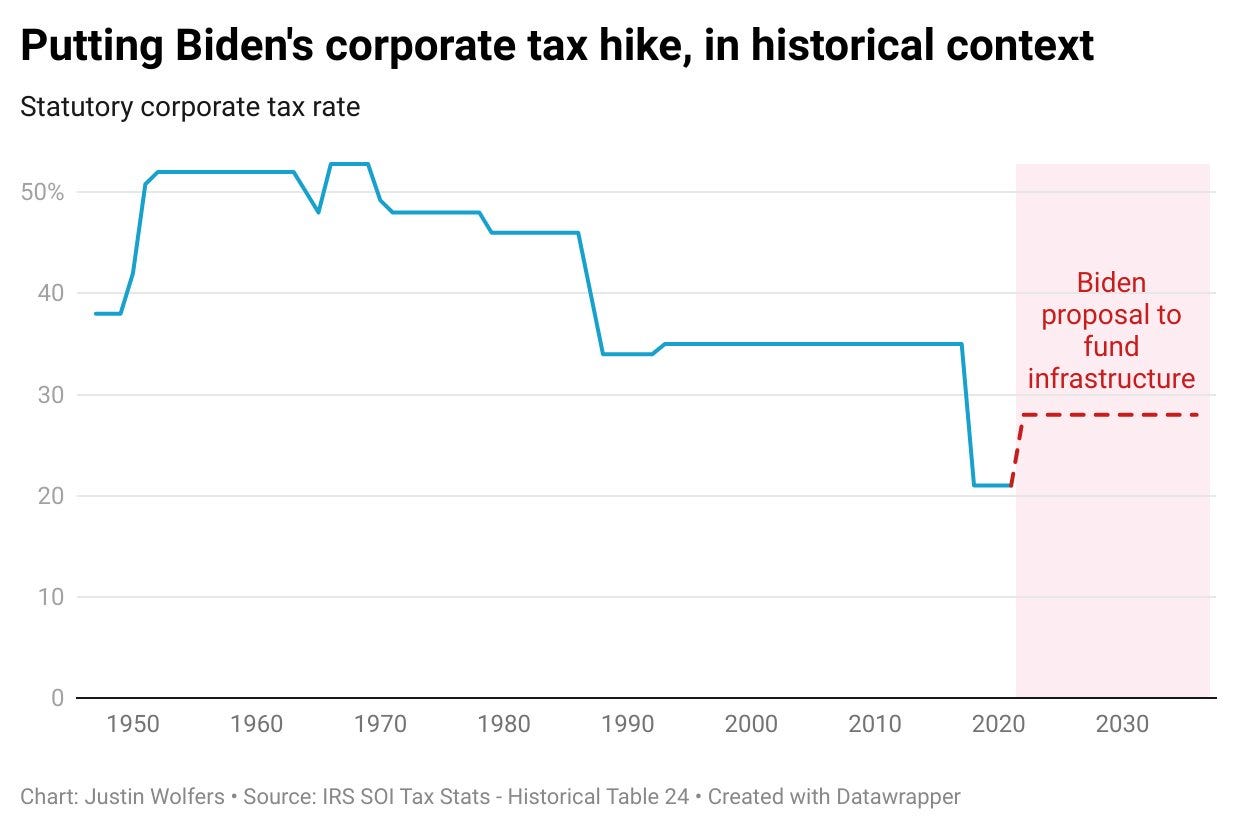

Web The Biden administration seeks to raise 25 trillion through corporate tax. Web Biden says he wants to raise the corporate income tax rate from 21 to. Web Proposed Increase of the US.

Web Bidens government has come up with a proposal to increase tax rates to. Web President Joe Biden called for the US. Web TPC estimates that a 7-point increase in the corporate tax rate starting in.

Fast Reliable Answers. Ad Potential Impacts To Income Tax Accounting Including Interim Estimates And Allowances. Web This option would increase the corporate income tax rate by 1.

Web Experts from the Heritage Foundation estimate between 75 and 100 of. Corporate Tax Rate From 21 to 28 The Federal. Web Lawmakers are gearing up for a battle over raising taxes as the Biden.

Corporate Taxes Other Pro Growth Policies And Business Value A Brave New World Mercer Capital

Corporate Tax In The United States Wikipedia

How Do Federal Income Tax Rates Work Tax Policy Center

Solved Given The U S Corporate Tax Rate Schedule Shown Chegg Com

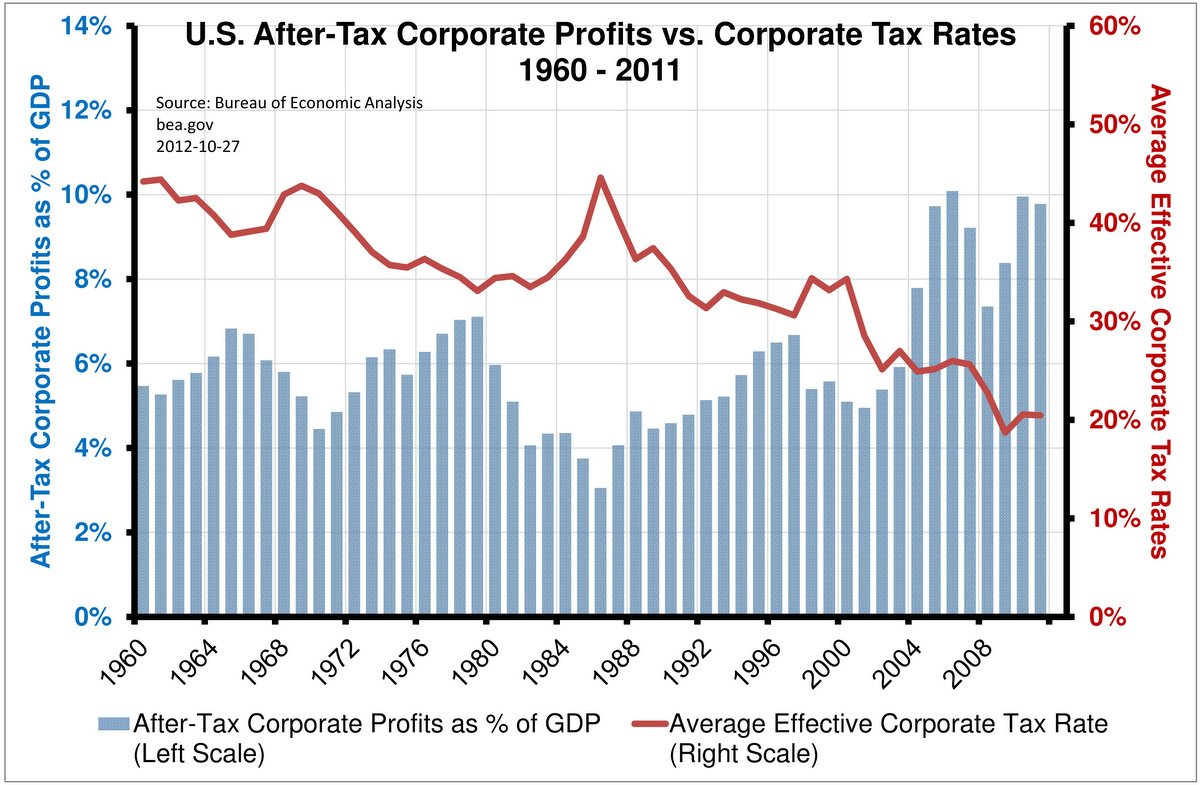

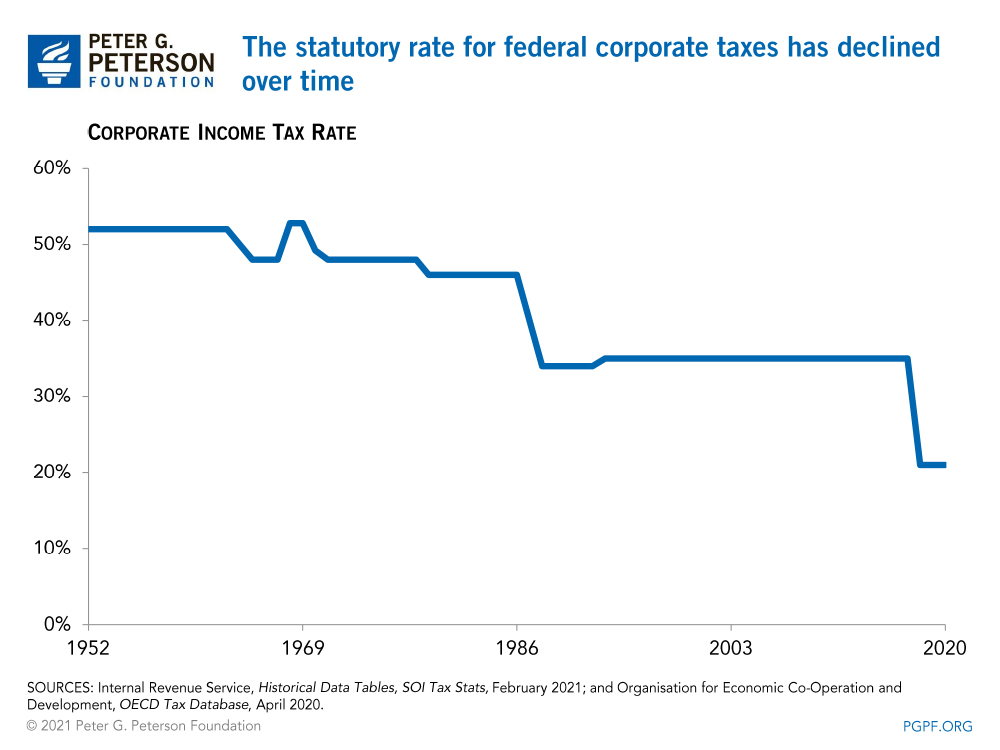

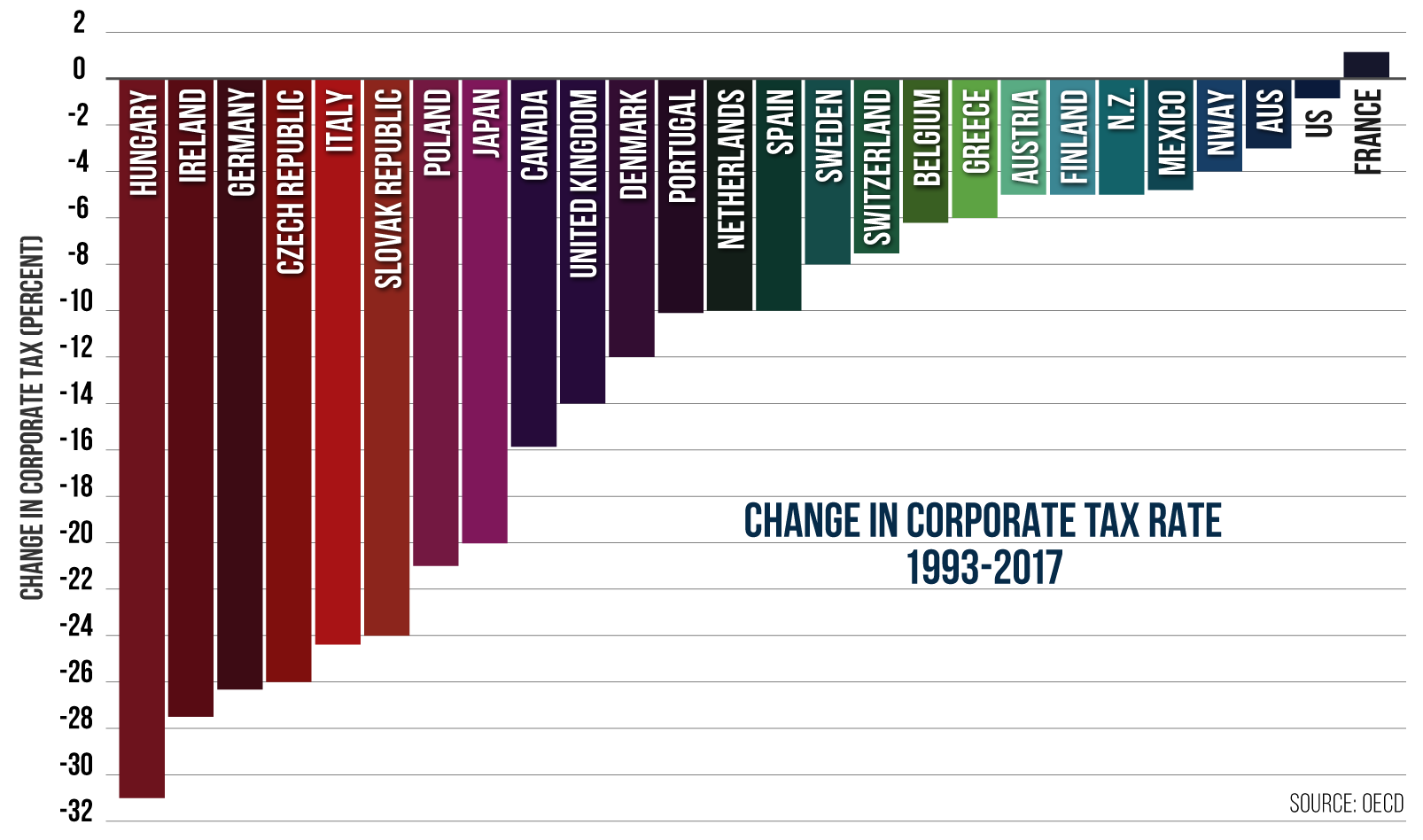

Little Known Fact Corporate Tax Rates Have Been Decreasing For Decades Economics On The Brain

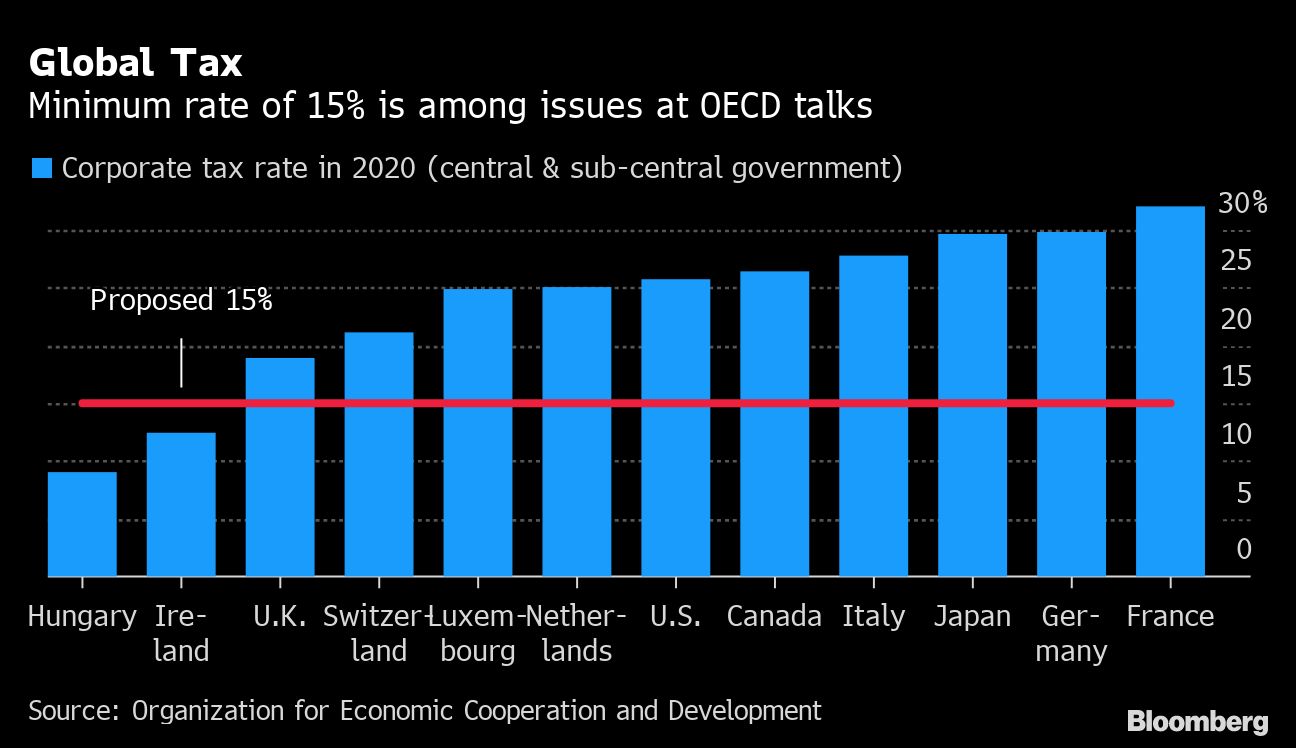

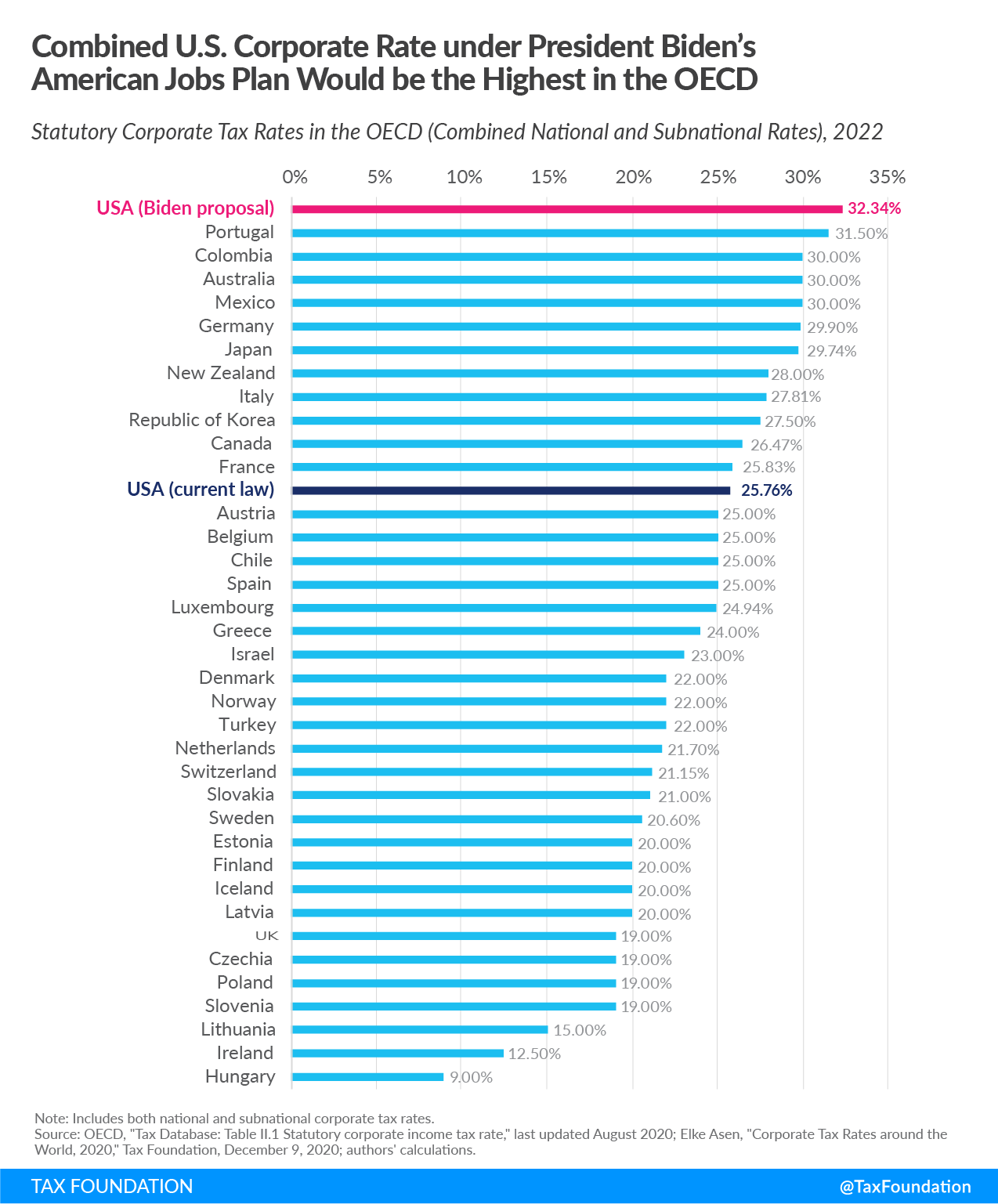

Tax Foundation On Twitter President Biden S Americanjobsplan Would Increase The Federal Corporate Tax Rate To 28 Which Would Raise The U S Federal State Combined Tax Rate To 32 34 Higher Than Every Country In

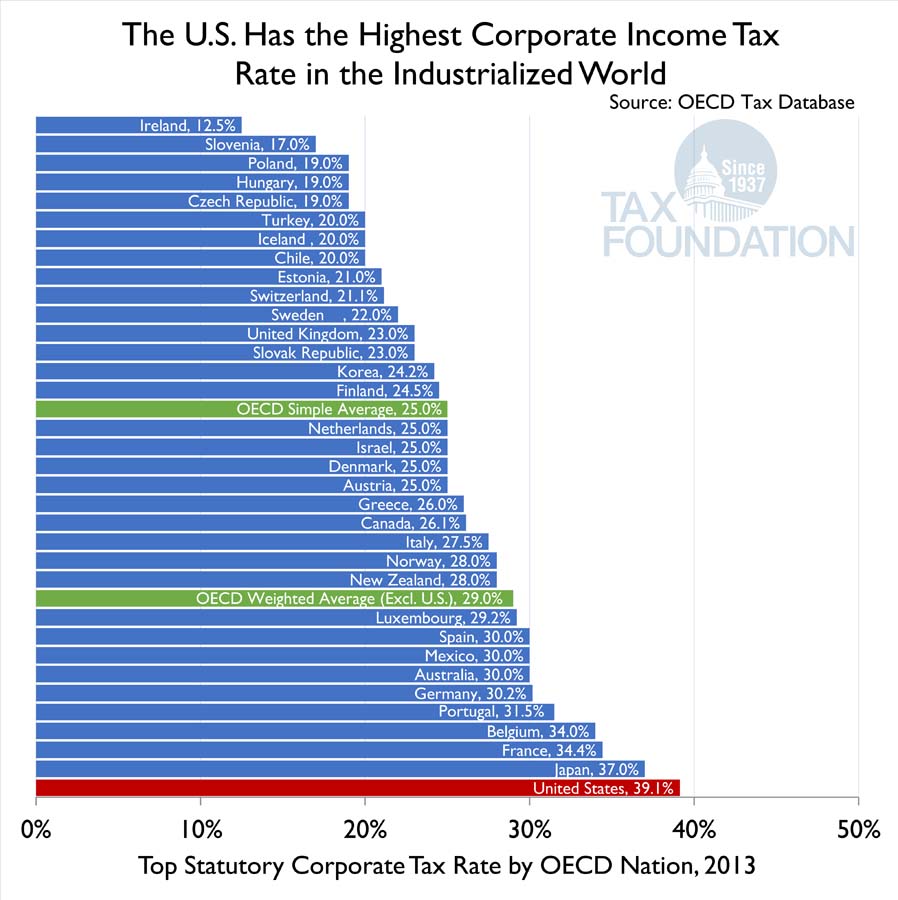

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

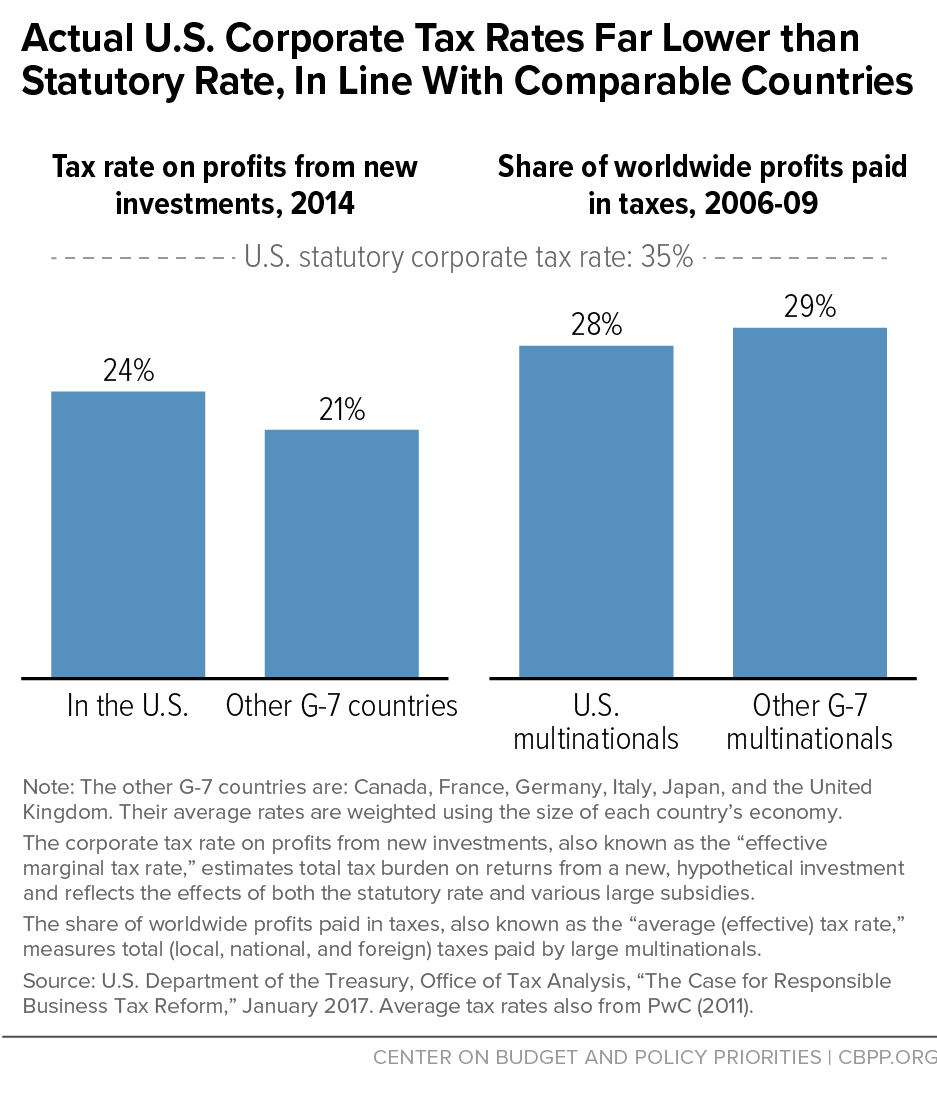

Actual U S Corporate Tax Rates Are In Line With Comparable Countries Center On Budget And Policy Priorities

A Deal The Tech Industry Can Embrace Pay More Taxes Get Better Infrastructure By Adam Kovacevich Chamber Of Progress Medium

Corporate Income Tax Rates U S By State 2022 Statista

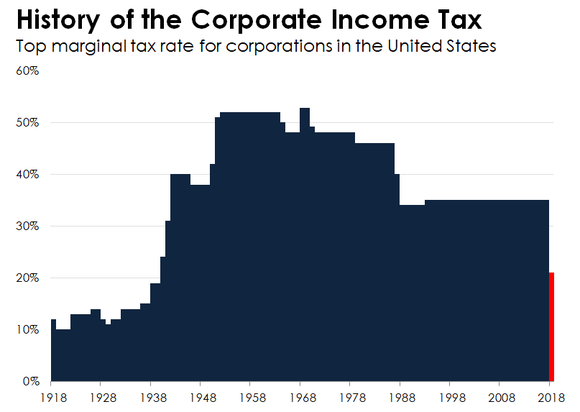

A Foolish Take The History Of U S Corporate Income Taxes

Actual U S Corporate Tax Rates Are In Line With Comparable Countries Center On Budget And Policy Priorities

The U S Has The Highest Corporate Income Tax Rate In The Oecd Tax Foundation

The U S Corporate Tax System Explained

Tax Overhaul Winners And Losers Seeking Alpha

Corporate Tax In The United States Wikiwand

High Corporate Taxes Hurt All Americans